Google banks on Google Pay’s future as financial management app

Consumers can now use Google Pay for activities such as automatically redeeming retailer discounts and setting up bank accounts.

Google has relaunched its Google Pay tap-to-pay app as a unified platform for financial services, including banking. The redesigned Google Pay offers a broad assortment of features that positions it in the same niche as financial apps such as Apple Pay, Samsung Pay, and PayPal.

Since its 2015 launch as Android Pay, Google says Google Pay has grown to more than 150 million monthly users in 30 countries. Starting in the U.S., Google is launching a redesigned Google Pay app on Android and iOS.

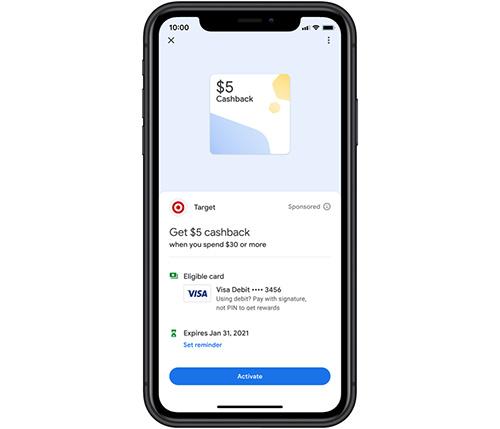

Retailers including Target, Burger King, REI, Etsy, Warby Parker, and Sweetgreen are now offering deals and discounts directly in the app. Customers can activate them with a tap, and they will be automatically applied when they pay in store or online. In addition, customers can use Google Pay to order food at over 100,000 restaurants, buy gas at over 30,000 gas stations, and pay for parking in over 400 cities, all from within the app.

One of the most interesting new features of the redesigned Google Pay is Plex, a new mobile-first bank account integrated into Google Pay. Plex accounts are offered by banks and credit unions and include checking and savings accounts with no monthly fees, overdraft charges or minimum balance requirements. Starting in 2021, 11 U.S. banks and credit unions including Citi, Stanford Federal Credit Union (SFCU), and Green Dot will start offering Plex accounts in Google Pay. In the meantime, consumers can join the waitlist on the app and be one of the first to apply for a plex account from Citi or SFCU.

Google Pay also now offers a number of features designed to streamline and personalize financial management activities for consumers. Customers who connect their bank accounts or cards to Google Pay will receive periodic spending summaries and see their trends and insights over time. Google Pay can also understand and automatically organize spending. This lets users search across their transactions using Google’s functionality, with terms such as “food” or “last month.”

And instead of showing a stack of cards or a list of transactions, the new Google Pay app enables users to pay, see past transactions, and find offers and loyalty information, all organized around conversations. Users can choose whether they would like to use their transaction history to personalize their experience within the app. The app will also enable users to create groups for split payments, as well as keep track of who has paid and do the math on who owes what.

Security measures include alerts for when a user might be paying a stranger, customizable privacy settings, and never selling user data to third parties or sharing user transaction history with the rest of Google for targeting ads.

“I’m intrigued by the rewards potential,” said Ted Rossman, Bankrate industry analyst. “This essentially blends online shopping portals and card-linked offers. Many users will probably centralize on Google Pay because it’s comprehensive and easy. Maximizers should do the math to compare with other offerings.”